Illicit Financial Flows support criminal activities and have a major impact on economic stability globally. Identifying and stopping them is crucial, however their complex and diverse nature makes doing so particularly challenging.

In this article, we’ll explore the role Open Source Intelligence (OSINT) can play in overcoming these challenges. Read on to see how OSINT enables organisations to leverage publicly available and licensable data in disrupting Illicit Financial Flows.

What are Illicit Financial Flows?

First, let’s define exactly what Illicit Financial Flows (IFFs) are.

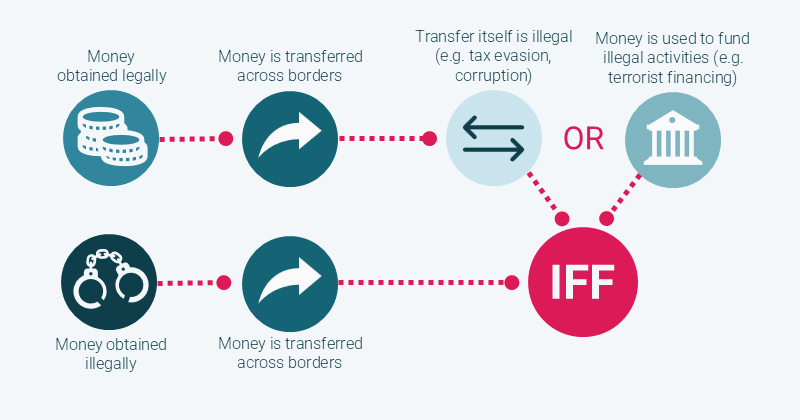

IFFs are the movement of money across international borders, where that money is either:

- Illegal in its origin: the money being moved represents the profits of criminal activity such as trafficking. In this case, the IFF might be part of a wider money laundering scheme.

- Illegal in its use: the money is moved so that it can fund illicit activity, such as terrorist groups. Before this transfer, the funds may have been obtained legitimately.

- Illegal in its transfer: the money is obtained legitimately, but the transfer itself is illegal. This is most common in cases of tax evasion and corruption.

Clearly, all IFFs involve an illegal element. However, it’s important to remember that the funds behind IFFs aren’t always obtained illegally.

Due to their opaque nature, it’s difficult to understand the true scale of IFFs. However, organisations are making strides in producing accurate estimates and it’s likely their scale is bigger than initially assumed. For example, a recent estimate suggests that Bangladesh is losing $480.7 million annually from drugs trafficking related IFFs.1

Countering IFFs

The fact that IFFs refer to such a large variety of activities makes countering them difficult. However, it’s crucial that we find ways to do so. IFFs support criminal networks, allowing crimes like human, drug and weapon trafficking to continue. On top of this, they have a huge effect on global economies, inflating pricing and reducing tax revenue. This often has the greatest effect on the countries which need this revenue the most.2

In this article, we’ll explore the role Open Source Intelligence (OSINT) can play in disrupting IFFs. Read on to understand how OSINT can support the construction of a fairer global economy.

Whose responsibility is it to stop Illicit Financial Flows?

IFFs have a huge impact on tax revenue and major links to organised crime. Due to these factors, countering IFFs might seem like it’s predominantly a public sector problem.

However, the reality is that stopping IFFs is a responsibility shared by both public and private sector organisations. Only by working collaboratively can we hope to counter these elaborate financial schemes.

Suggested reading: Public-Private Partnerships present a great example of cross-sector collaboration. Understand how OSINT helps them produce effective results by reading the blog.

Private sector firms and financial institutions

Illicit financial flows rely heavily on private sector firms such as banks. In fact, criminals would struggle to generate, move or benefit from funds without them. Thus, financial institutions have a major role to play in countering them.

By strengthening their existing anti-financial crime (AFC) programmes, financial institutions can identify and prevent IFFs. Key areas of focus include:

- Anti-money laundering (AML): making funds usable is one of the main incentives for IFFs that are illegal in origin. Therefore, by bolstering AML processes, banks can help combat IFFs.

- Counter-terrorist financing (CTF): many IFFs defined as ‘illegal in use’ are such because the funds finance terrorist groups. This makes CTF programmes an even more important consideration for financial institutions.

- Enhanced due diligence (EDD): understanding subject networks is crucial to accurately identifying the source and use of funds. Strong EDD processes allow financial institutions to achieve this, especially where large sums of money are involved.

Later in the article, we’ll explore how financial institutions can use OSINT to strengthen these AFC processes.

Public sector organisations and leading by example

Cross-sector collaboration is key to countering IFFs effectively.

However, public sector must often be the leaders of this effort. It’s up to public sector organisations to set the laws and regulations which private sector firms follow. By requiring stricter AFC processes, public sector bodies motivate private firms to become active participants in the fight against IFFs.

Public sector organisations also have a direct role to play in countering IFFs. Many IFFs that are illegal in transfer are related to tax evasion, which is largely countered by the public sector.

Suggested reading: like tax evasion, welfare system fraud is a major concern for public sector organisations. See how OSINT can be used to counter this growing problem in our article.

Using OSINT to stop illicit financial flows

OSINT is a key resource for countering IFFs. It allows investigators to build out comprehensive corporate and personal networks, which are crucial to countering any financial crime.

In this section, we’ll explore which OSINT sources are most useful and how investigators countering IFFs should use them.

Understanding corporate structures

For Illicit Financial Flows to succeed, they must operate behind a veil of legitimacy. This is often achieved using complex corporate structures and shell companies. Consequently, corporate records and beneficial ownership information are essential to countering IFFs.3

Such data is usually publicly available or licensable, meaning it can be used within OSINT investigations. It’s crucial for building out the corporate networks behind IFFs and it supports the identification of structures like shell companies. Investigators should look out for red flags such as a large number of companies with shared directors, names or addresses.4

However, IFF-related corporate networks are likely to be large and complex. Without the right technology, investigators can only get so far in understanding them. Therefore, investigators must be armed with an OSINT solution that allows them to visualise large networks in an intuitive way. This will enable them to get to the heart of a case faster.

Going beyond official records

Corporate records are a key focus for IFF investigations, but they’re not the only way that OSINT can contribute to the fight against IFFs.

One of the unique benefits of OSINT is that it allows investigators to explore a wide range of sources. This means OSINT investigators can uncover information that’s intentionally concealed in ‘official’ sources. For example, an individual behind an IFF will intentionally obscure their illicit activity on official channels. But strong links to a foreign country or certain companies or individuals online might tell a different story.

The sources available to OSINT investigators include:

- Publicly available social media

- Adverse news

- Online forums

- Leaks and investigations like the Panama Papers

When it comes to tax evasion, OSINT can be particularly useful. That’s because it allows investigators to look at the lifestyle a suspected individual shares online. If they appear to have a luxurious, expensive lifestyle, does this align with their declared income? If not, it’s possible that tax evasion could be at play. It might even be a sign that the individual is involved in other criminal activities.

As with using OSINT to explore corporate structures, technology can be huge asset to the investigator. The right OSINT platform allows users to access sources securely and find the data they need faster.

Furthering the fight against IFFs

Whilst IFFs remain a complex and challenging issue, stopping them is far from impossible. We’re closer to understanding the scale of illicit financial activity than we were before. On top of this, emerging investigative techniques and technologies are making the fight easier.

OSINT is likely to play an increasing role in this space, offering unique benefits to organisations countering IFFs. From allowing deeper insights to promoting better cross-sector collaboration, OSINT should be considered a major asset in this fight.

Suggested reading: see how organisations are already using OSINT to counter a range of financial crimes in this handbook.

- Efforts to track illicit financial flows need scaling up

- The IMF and the Fight Against Illicit Financial Flows

- World Bank Group

- 7 indicators of shell company risk – Moody’s