Sanctions Investigations

Sanctions lists are only the start of effective sanctions investigations. Complex corporate networks, opaque jurisdictions and nominee directors can all obscure beneficial ownership.

Videris helps investigators cut through the noise to identify and resolve hidden sanctions risk.

Understand sanctions exposure with OSINT

Changing sanctions regimes and evolving evasion tactics are making sanctions investigations harder. Investigators must go beyond watchlists to form an accurate picture of an entity’s sanctions exposure.

Open source intelligence (OSINT) enhances sanctions investigations by allowing teams to gain a fuller picture of network risk.

Why Videris?

Conducting sanctions investigations manually can be slow and ineffective. Investigators need a solution that streamlines sanctions operations and lets them understand the available data in a fraction of the time. Videris is designed to meet this need.

Future-proof sanctions capability

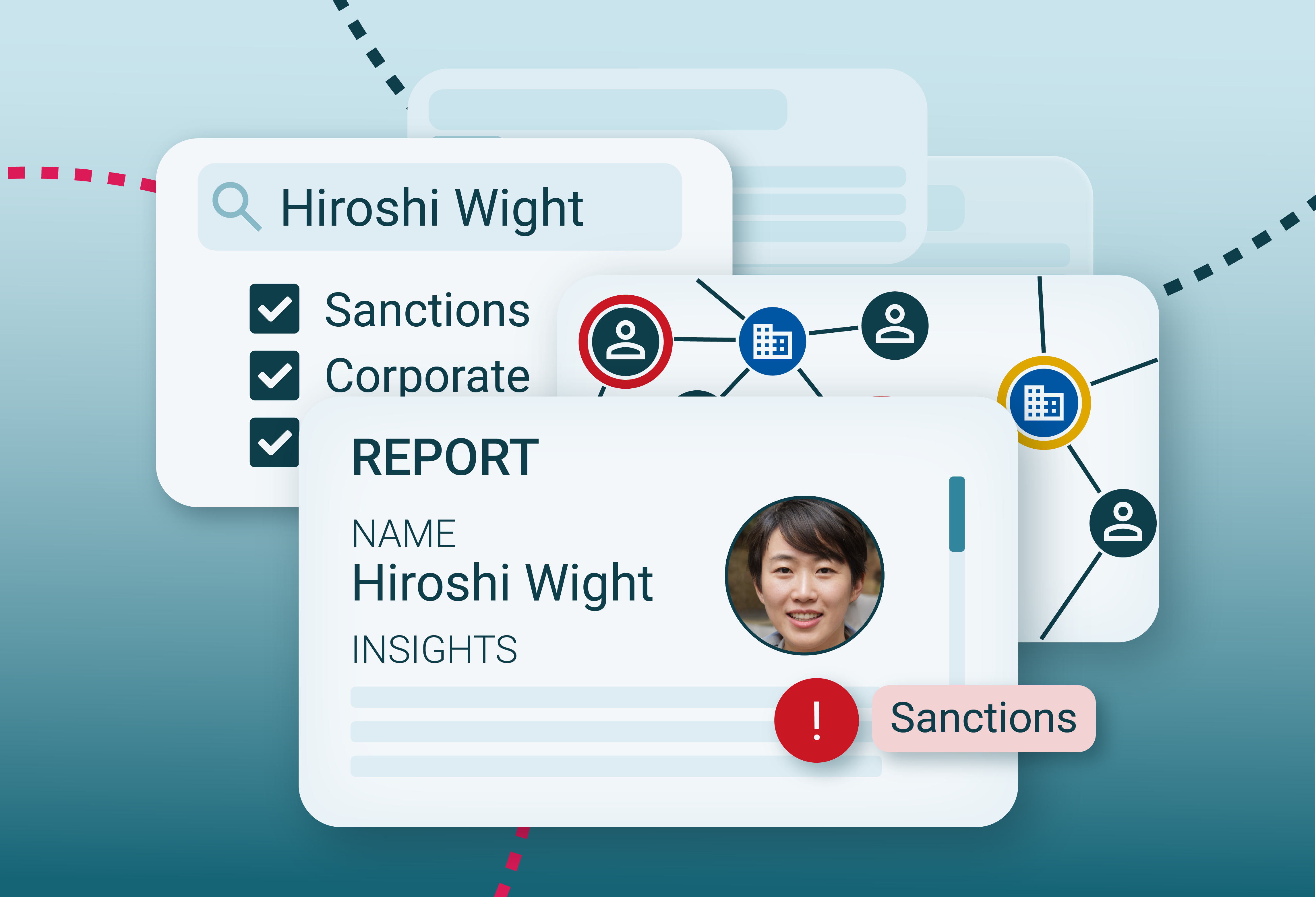

Sanctions teams need to understand where a subject might be sanctioned by extension or using evasion tactics. Watchlists only provide a fraction of the full picture and are constantly changing.

Videris lets investigators supplement watchlists with live internet data to ensure that teams can always stay ahead of sanctions evasion.

Harness the power of OSINT

OSINT is key to effective sanctions investigation, but large volumes of data and security concerns can make it hard to implement.

Videris allows regulated entities to use OSINT securely, accurately and efficiently in a single intelligence platform.

Meet regulatory requirements

Ensuring adherence to sanctions regimes is easier with OSINT. Guarantee more accurate results by consulting more sources and making effective use of automation.

Identify less obvious connections to sanctioned entities to meet regulatory requirements as they continue to change and tighten.

Features

Centralised data access

Reduce human error and streamline investigations by accessing all data sources in one place, rather than switching between platforms.

With Videris, investigators can access sources such as PEP and sanctions watchlists, corporate records, publicly available social media and live internet data, and view them alongside internal data.

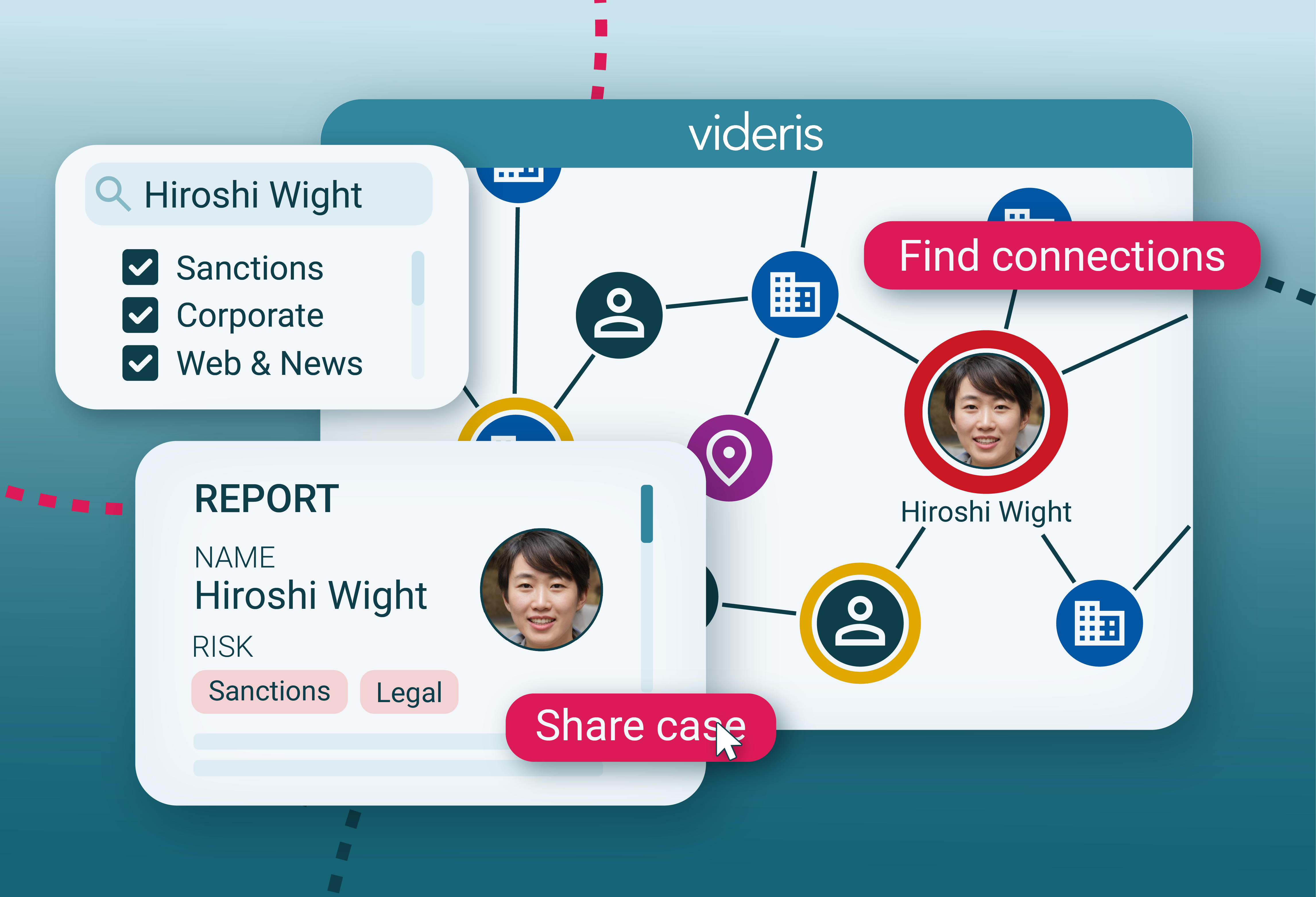

Network analysis

Videris’s visualisation and analysis features allow investigators to understand complex networks and identify connections, saving time and leading to better outcomes.

Uncover hidden links to sanctioned entities and reveal the true ownership of companies and assets.

Operationalised OSINT

When using online data, investigators must take extra measures to ensure that their operations remain secure, anonymous and auditable.

Videris ensures that data is collected anonymously and investigations remain secure, while logging every action and finding.

See Videris in action

See how teams across a range of industries are using Videris to derive more insights in less time by reading our case studies.

OSINT Insights

Get OSINT insights and Blackdot news by reading our blog.

What we learnt from Counter Fraud: Barriers to transitioning from detection to prevention

Last week, our team attended the GovNet Counter Fraud Conference 2026. With topics of discussion ranging from understanding data to...

By Annie Finlay

Big data, network analysis and the right tools in OSINT with Chris P.

Chris P, Head of Intelligence at Blackdot, joined the latest episode of From the Source, the Blackdot podcast. He discussed his diverse...

By Rebecca Lindley

Top 3 insights for Financial Services from The State of OSINT

Financial services (FS) investigation professionals are uniquely positioned to disrupt the flow of funds to criminals. The stakes are high:...

By Charli Foreman

Streamline your sanctions screening investigations

Identify connections to sanctioned entities more effectively with a complete investigations solution.