A desire to fight financial crime

Over the past few years we’ve noticed a shift within AML and financial crime teams, away from ‘box-ticking’, in favour of a more investigative model. AML professionals are increasingly prioritising the tackling of money laundering and other financial crimes, rather than merely complying with regulatory requirements. This is a positive development indeed.

Another observation we’ve made, however, is that the teams undertaking complex AML investigations are often under-resourced. This is especially true in relation to the technologies they use to exploit publicly available data. Such a capability shortfall can hamper investigators’ ability to drive tangible improvements in financial crime outcomes.

A technology deficit

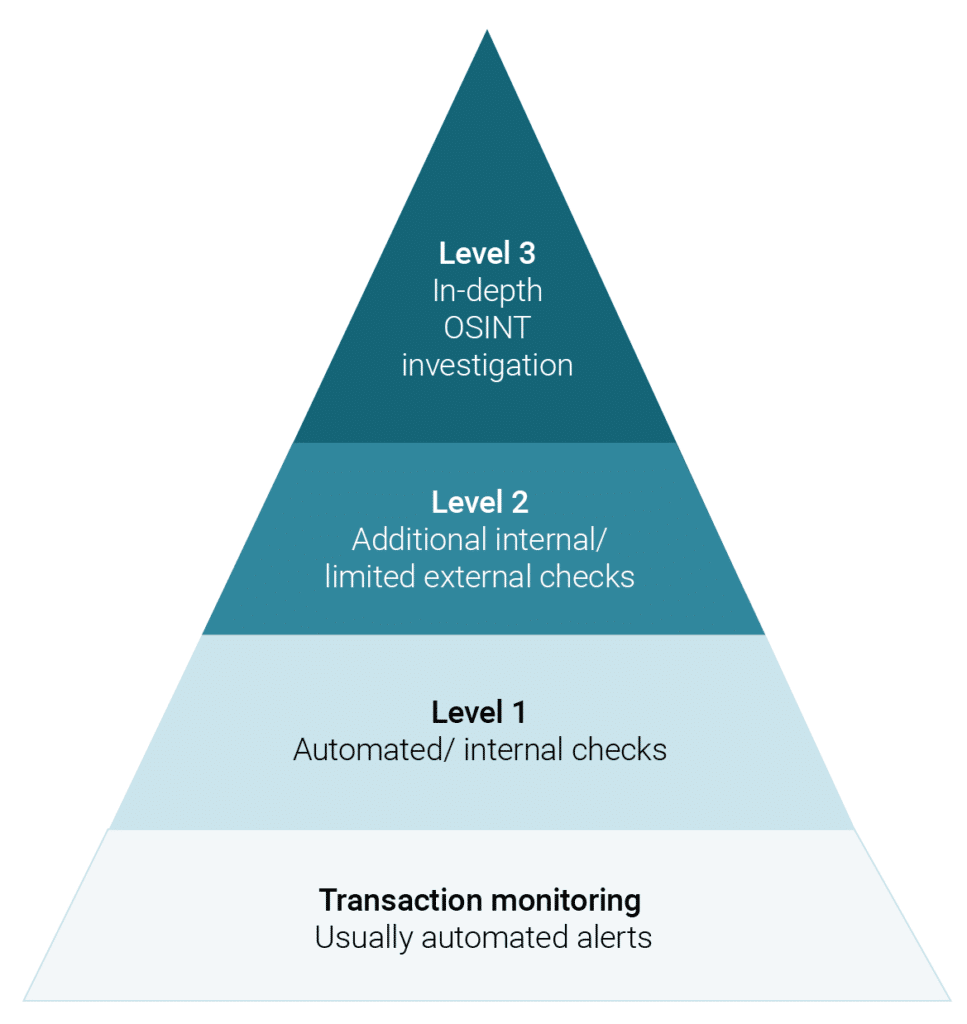

If we think of AML investigations as a pyramid, vast budget and resources are often devoted to operating a range of sophisticated technologies at the lower tiers – including automated transaction monitoring and screening tools. However, high risk/ complex case teams operating at the ‘top end of the pyramid’ often rely on largely manual processes to support their work.

We argue that this technology deficit needs to be addressed.

In particular, complex investigations teams need to be equipped with technologies that radically improve the way they exploit open source data.

Why use open source data?

Open source data is publicly available data – which includes corporate filings, news articles, social media or anything you can find on search engines like Google.

When it comes to complex AML investigations, this kind of data is critical because:

- It can provide analysts with a more contextual understanding of customers, counter parties or transactions. This leads to better risk decisions and higher quality SARs.

- Curated databases can quickly become out of date, so it’s important to also use live open source to avoid missing key information.

- It is a huge and growing resource.

UK and European regulators understand the importance of using open source information referring to it multiple times in their official financial crime guidance. For example the EBA suggests that banks should be “taking steps to better understand the ownership or background of other parties to the transaction…This may include checks of company registries and third party intelligence sources, and open source internet searches“.

The challenges of open source

However, working with open source information can be challenging, particularly in a regulated environment:

- Speed and efficiency: Analysts typically rely on time-intensive manual processes and tools that aren’t designed to work together. For example, they might be searching Google one minute and looking up a companies, connected directors and UBOs in a corporate registry the next. All of this is whilst trying to keep track of information in a spreadsheet, plot connections on a chart and draft a report in a word document. This constant task-switching makes it hard to be efficient.

- Consistent processes: How can banks be certain that the AFC teams that are undertaking open source data-based investigations are adopting uniform workflows?

- Transparency: The process of accurately recording all of the steps involved in the collection and analysis of information drawn from online sources can be difficult and time-consuming. Banks need to ensure that these workflows are uniform.

- Security: It’s important for investigators to remain anonymous when undertaking research online – for example, to avoid tipping off the subject of an investigation. This requires a lot of training and technical skills.

What kind of technology can help?

The world of AML and financial crime technology is awash with tech jargon – from AI to RPA to machine learning. All of these kinds of technology can be useful depending on the stage and type of investigation in question.

AI and machine learning generally suit high-volume applications, such as detecting anomalies in patterns, looking for links or connections in a dataset, or prioritising results for review. However, these technologies are less useful in multi-step processes requiring human intervention along the way. Robotic Process Automation (RPA) is helpful when repeating simple manual tasks but is also less useful where human judgement is needed.

Rather than AI, Videris uses an approach that we call IA (Intelligent Automation). Intelligent automation enables a human user to exploit their experience and domain expertise to decide the direction of their investigation. But they’re also able to leverage technology to automate repetitive manual tasks. This might include rapidly mapping corporate networks in just a few clicks. It could be collecting information from multiple different sources at once and categorising it for ease of use. Videris also highlights connections within information that might have been hard to spot using manual processes. The aim is to use technology to augment but not replace the analyst.

How Videris can improve financial crime outcomes

Speed and efficiency : Videris brings all of the required tools and sources into one place, reducing the inefficiency of switching between many different systems. It also automates manual tasks where the analyst’s judgement isn’t needed. Banks are able to achieve more accurate results, leading to better decisions and reduced exposure to risk.

Security: Videris’ roots are in technology designed for law enforcement and government intelligence. It provides a high level of security and anonymity when using the wider internet.

Transparency and Consistency: Videris ensures that all activities are logged and recorded. Supporting evidence is automatically captured and fully auditable. Using a single, dedicated tool for investigations also makes it easier to achieve consistency.

The net result is that AML and financial crime teams using Videris are able to resolve complex cases quickly and accurately. And, higher quality information helps banks to submit more detailed and actionable SARs to national FIUs.

Conclusion

The move towards an investigative financial crime model is encouraging, but it’s vitally important that complex investigations teams have the right tools to exploit open source data. By investing in better technology at the top of the AML pyramid, banks can transform their investigations capability. The right AML investigation software brings increased security, efficiency and consistency while driving better financial crime outcomes.