Three Strategies To Make Adverse Media Checks More Efficient

Why are Adverse Media Checks so important?

Adverse media checks, also known as negative news screening, are essential for firms to identify and mitigate risk. Vital from both a regulatory and risk management perspective, organisations can leverage a growing catalogue of online open-source information to scan for incriminating news and risk factors, making better-informed decisions about the clients they do business with.

Because of its utility, adverse media screening is an integral part of a risk-based approach, which is advocated for by industry authorities like the Financial Action Task Force (FATF). A risk-based approach is centred on understanding an individual client’s risk profile and tailoring processes accordingly, which means distributing resources effectively to prioritise what is higher risk.

However, to deem some clients higher-risk than others, firms must truly know the client throughout the entire relationship – and that means keeping aware of potential and emerging risks that may be uncovered through adverse media checks.

Suggested Reading: Adverse media checks also form a fundamental part of Supply Chain Due Diligence (SCDD). Read more here about how companies can use Open Source Intelligence to better understand and mitigate risk through the SCDD process.

Challenges of Adverse Media Checks

While adverse media checks are a core component of a risk-based approach, they do have some notable challenges, including:

- Data volumes: The sheer volume of data on the internet makes it difficult to process findings. Some estimates state that around 1.145 trillion MB of data is created daily, which makes finding a way to systematically assess and review that data a challenge for individual firms and researchers.

- Entity resolution: Analysts may find it difficult to determine if a finding truly pertains to their subject and may waste valuable time cross-verifying information across numerous databases and resources.

- Language barriers: Analysts and translation engines have to contend with complex foreign scripts and characters to be certain of good coverage and effectiveness.

- Reliance on manual processes: Some organisations may rely on using online search engines like Google for their adverse media checks. While these tools have their use, they are limited in their ability to screen for subjects effectively. The Wolfsberg Group, an authority on anti-financial crime, recently published guidance on this exact topic, describing them as content browsing mechanisms that may produce inconsistent results, even with the use of Boolean operators. Instead, more sophisticated tools must be used to screen for financial crime risk effectively.

For these reasons and more, firms may struggle with implementing an effective adverse media approach. This blog outlines three key strategies to employ when considering adverse media screening tools for your firm and to ensure the deployment of an effective adverse media screening process.

Adverse Media Check Strategy #1: Prioritise a good user experience for your teams

Fundamentally, adverse media screening tools should be designed to enhance the work of your teams – not frustrate, confuse, or replace them. While technology has developed tremendously in recent years, your people will still do the critical thinking and ultimately make the final analysis. To assist your team in carrying out their job, it is vital to find a tool and process that is intuitive by design. One key design element is a solution that uses one interface.

Research has shown that humans are not natural multitaskers, and so having too many platforms, databases, and interfaces can slow down an investigation and even lead to human error. When conducting adverse media checks, there will be vast amounts of data to check and numerous sources to screen through, which can bog down an investigation process. Tools that pull from multiple sources to present findings in a singular and organised fashion assist the researchers and the overall investigation process.

From a technical perspective, tools should be easily integrate-able with existing platforms and case management systems. Depending on the firm’s requirements, having the appropriate delivery mechanisms, such as on a software-as-a-service platform, on the cloud, or on-premise, is essential to minimise disruption. Each firm has its own unique technical requirements, and solutions should easily integrate to avoid unnecessary backend disruption – which can translate to costly operational strains.

While the adverse media screening tool you select should be intuitive by design and therefore facilitate a smooth transition and learning period for staff, ensure there is adequate training before, during, and after implementation. Sufficient resources and clear documentation on adverse media screening processes should be easily available to ensure consistent processes are followed. From a technical standpoint, firms should build in extra buffer time for technology deployment to ensure a smooth transition for their teams.

Suggested Reading: Find out more here about how to choose the tool that’s right for your team.

Adverse Media Check Strategy #2: Include visualisation and network analytic capabilities

Visuals aid human cognition. Some statistics have shown that 65% of the population are visual learners, meaning staff on your team likely fall into this category. Visual reinforcements meaningfully assist your team with processing information and carrying out research. When conducting adverse media screening, sources can range widely from official government records to unverified social media posts. The unstructured data found in these sources must be presented coherently and neatly, which is difficult to do manually and with text alone.

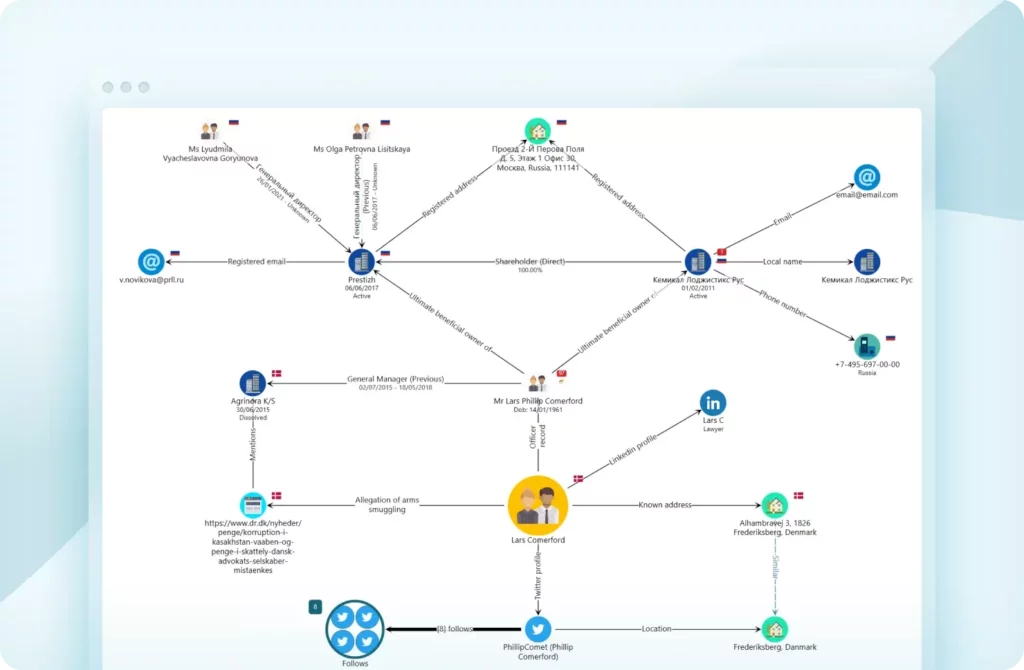

Instead, capturing and displaying findings visually can help highlight links to your subject and automatically synthesise disparate information into a clean and coherent format. This allows researchers to see the relevant information immediately, including the source, without needing to switch through endless tabs and organise the data themselves.

Network maps are especially crucial for complex cases where corporate ownerships span multiple jurisdictions and data comes from different registries or sources, aiding in untangling ownership or other connections. These visual outputs speed up investigations and help analysts make links and come to conclusions more effectively.

Other easily-digestible formats, such as dashboards or graphs, allow for quicker insights, as researchers can quickly identify the information relevant to their investigation and better identify anomalies and patterns. All these factors translate to faster decision-making and quicker investigations, making for more efficient adverse media checks.

Suggested Reading: Understanding whether your clients have any connections to sanctioned entities is an essential part of identifying and mitigating risk. Read more about how this can be done more efficiently and effectively using network visualisation tools here.

Adverse Media Check Strategy #3: Use artificial intelligence for the best results

Adverse media checks are only effective if online findings are captured properly. Realistically, effective adverse media checks cannot be done with manual searches alone. Along with the already-discussed shortcomings of traditional internet search engines, which are based on algorithms and are not designed to capture information for anti-financial crime investigations, there is simply too much information to sift through. Tools that employ advanced capabilities like artificial intelligence (AI) are essential for conducting effective adverse media checks at scale.

One branch of AI known as natural language processing (NLP) can assess if findings denote actual risk, instead of retrieving non-relevant information about a subject. For example, if a subject is quoted in a media article criticising the levels of corruption in a particular sector, this does not represent a potential risk – it is vital to understand the connection between the subject and the word “corruption”. This allows analysts to focus their time on relevant findings.

Additionally, these tools should not be limited to English and should be able to screen through foreign languages with different scripts and characters, ensuring everything relevant is captured regardless of the jurisdiction. The use of AI allows analysts to focus on actually analysing the findings in a methodological and organised manner rather than determining their relevance. Additionally, it helps minimise the risk of missing important findings due to language differences or the inability to screen through extensive online sources.

Good AI tools also categorise relevant hits in an optimal way that is easy for the researcher to use. Do the risks located pertain to financial crime risk? Extremism? A data leak? Neatly categorising findings assists researchers in conducting more streamlined analysis. Especially for complex cases with multiple important data points, prioritising alerts for relevancy allows for a smoother investigation. These factors combined allow for faster, smoother investigations, saving an organisation both time and money.

Technology has increasingly been recognised as an asset to fighting financial crime. Most notably, the FATF recognised advanced technological capabilities like NLP and fuzzy matching tools as being more efficient at reducing false positives in adverse media screening. In the face of extraordinary amounts of online data, using AI tools is the only way to conduct adverse media checks efficiently.

Features to look for in an AI adverse media check tool:

- Ability to triage and prioritise alerts

- Ability to sort and rank for reliability

- Ability to differentiate and categorise between types of risk (e.g. financial crime risk, serious and organised crime, political, extremism, offshore leaks, etc.)

- Augments existing systems, rather than ‘ripping and replacing’

- Fully explainable, configurable, and easy to use

- Ability to integrate into case management systems

- Varied and suitable delivery mechanisms (e.g. SaaS platform, on a cloud, on premise, etc.)

Suggested Reading: Discover how adverse media tools are adapting to meet developing challenges here.

How Videris Can Help With Adverse Media Checks

Prioritise your human teams

Videris focuses on improving the capabilities of human investigators, acting as a single pane of glass for all the sources investigators need, including external, internal and curated data. This reduces time spent multitasking by allowing investigators to collect and analyse all data in one place, providing huge efficiency savings.

Include visualisation / network analytical capabilities

Videris automates the visualisation of hard-to-understand data, improving the effectiveness of teams responsible for adverse media checks. Benefits include:

- Mapping of connectivity data, such as beneficial ownership networks and social networks, so that investigators and analysts can understand key links at a glance.

- Automatic flagging of data that may be similar or identical. Teams don’t need to spend time cross-referencing every name, address and number, and can find important connections quickly.

Use artificial intelligence for the best results

Videris uses explainable AI to make the use of live internet data accessible even to those conducting quick adverse media checks. Its risk search reviews live internet data and curated databases, summarises key risks and provides a risk score. Organisations gain confidence that effective adverse media screening need not impact efficiency, and investigators can be certain that they’ve identified all relevant risks.

Discover how Videris can help your team carry out truly efficient adverse media checks by booking a demo today.