From Registry to Gatekeeper: Companies House’s Strategic Intelligence Assessment and Its New Role in Combating Economic Crime

Companies House, the official registrar of UK companies, has recently published its first ever Strategic Intelligence Assessment. The role of Companies House has been transformed by recent legislative changes. It now has a mandate to combat economic crime more actively.

The Strategic Intelligence Assessment is the first demonstration of its new role as an intelligence player. Changes to Companies House data, and its new investigative and enforcement powers, strengthen the agency’s role as a vital source for open source investigations and a key partner in financial crime prevention.

What is Companies House?

Companies House is the official registrar of legal entities in the UK. This means it’s responsible for maintaining and providing public access to information about all incorporated entities.

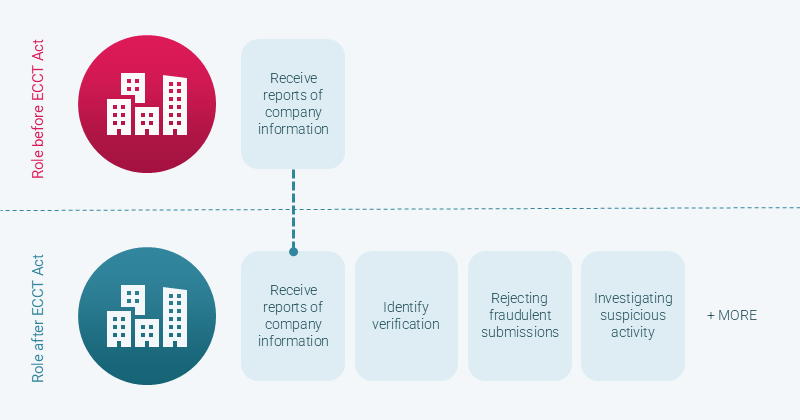

This open access to corporate data has long been a useful resource for researchers, journalists and regulators uncovering irregularities. However, the quality of the data has been a major concern. Traditionally, Companies House played a purely administrative role. It focused on receiving reports of company information, such as directors, shareholders and financial statements. Beyond this, it did not then actively verify the accuracy or completeness of submissions.

However, under the recent Economic Crime and Corporate Transparency Act, Companies House has undergone a significant transformation. The Act grants Companies House new responsibilities, including:

- Conducting identity verification for directors and beneficial owners

- Rejecting submissions that appear fraudulent or incomplete

- Proactively investigating suspicious activities within its registry

- Sharing intelligence with law enforcement agencies and other stakeholders

These powers mark a major shift from a passive role to an active one. Or, in Companies House’s own words, “from being a static register to a proactive gatekeeper”.

The Strategic Intelligence Assessment

The Strategic Intelligence Assessment (SIA), published last month, demonstrates Companies House’s new ambitions. Designed to underpin the work of a new intelligence team, it forms part of the entity’s work to align more closely to the National Intelligence Model. The value of this is very clear. The SIA shows that company incorporations in the UK exceed those anywhere else in the world. For example, in 2021, the UK incorporated 154% more companies than the next most active country, Australia. These company incorporations are only increasing year on year. As such, the assessment states that the scale of abuse of the UK company register continues to grow.

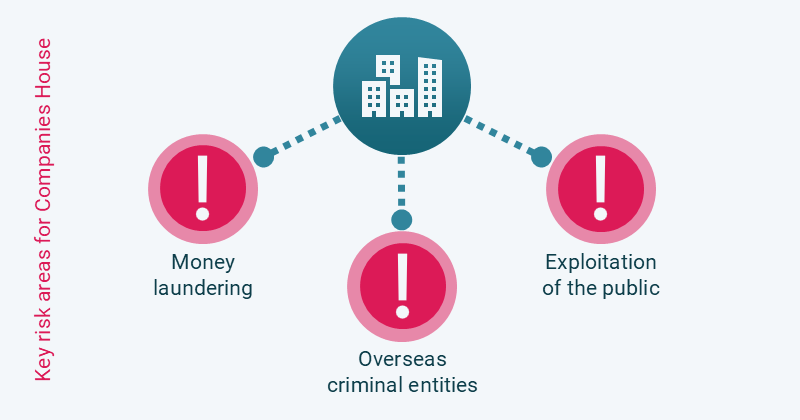

The SIA provides analysis of the key threats faced by Companies House to enable the design of a control strategy which sets out recommendations and action plans. It looks at threats and vulnerabilities in the UK’s corporate ecosystem, offering critical insights into how criminal actors exploit corporate structures. Among the top risk areas it highlights are the following:

Money laundering through UK limited companies

Criminals use certain UK business structures, like limited liability partnerships (LLPs) and limited partnerships (LPs), to commit money laundering, fraud, and other illicit activities. They find these structures particularly attractive due to ease of establishment, minimal reporting requirements, and the positive reputation of UK companies abroad.

Companies House has identified mass incorporations of UK limited companies, where hundreds or thousands of companies are registered in a short time, connected through a common entity (e.g. a shared address or director). Such companies are often dissolved after 12 months, following minimal interaction with Companies House.

The SIA states that the true scale of money laundering through UK limited companies is almost certainly underestimated However, it also explains that work is ongoing to fully understand the magnitude of the issue. In partnership with the Insolvency Service, Companies House is creating two new intelligence teams to tackle money laundering and improve our understanding of how UK companies are misused to launder the proceeds of crime.

Involvement of overseas criminal entities

The introduction of the Register of Overseas Entities in 2022 requires foreign owners of UK property to disclose their identities. The Register aims to address the serious issue of dirty money being laundered via and invested in UK real estate. This is particularly important due to the sharp increase in overseas property ownership in the UK and increased international tensions following Russia’s invasion of Ukraine. However, loopholes and gaps remain, with some entities able to obscure ultimate ownership through complex structures.

Exploitation of the public

Innocent members of the public can be exploited through Companies House processes. Criminals use their identities or addresses for fake company formations. Data leaks or identity theft often play a role here. The assessment also notes that deceased individuals, vulnerable people and vacant properties are often involved.

Between 2020 and 2023 requests to remove fraudulent director details increased by 183%, suggesting widespread abuse. The assessment states that the new identity verification process will help mitigate this risk. Consequently, Companies House hope to reduce the scale of this issue.

Suggested reading: Criminals often misuse Companies House to commit fraud. See how counter-fraud practitioners are using OSINT more widely here.

Using Companies House for OSINT research

Open-source intelligence (OSINT) researchers have long relied on Companies House data when conducting investigations. The upcoming reforms will make more data available and increase this data’s reliability. However, the SIA notes that sophisticated criminals can still evade the new measures, so processes will remain vulnerable to exploitation.

Identifying suspicious patterns

Investigators can use Companies House data to detect certain red flags highlighted in the SIA. Companies House will now also play an active role in investigating and identifying these illegal activities Where suspicious firms are present, it will have the power to take action against them. These actions include:

- Mass incorporations: A surge of registrations sharing common directors or addresses.

- Paper directors/owners: Individuals with no genuine control over the company. Investigators can identify these by comparing registry data points such as age and address with other sources.

- Cloned companies: Entities mimicking the details of legitimate businesses. Criminals often use these for scams which rely on the reputation of the ‘real’ company, and for VAT fraud.

- Phoenix companies: Firms whose incorporation is followed by a period of debt acquisition, followed by the transfer of assets to a new (often newly created) entity, followed by dissolution of the initial company. This ‘divorcing’ of the debts from the assets is designed to evade creditors and law enforcement.

- Company hijacks: Changing the registered office addresses of legitimate companies so hijackers can use the entity, e.g. to take on debt or sell for a profit.

Additional data

As well as having new investigation and enforcement powers, Companies House now collects an increased scope of data thanks to the Economic Crime and Corporate Transparency Act. This increased scope includes:

- Management of the relatively new Register of Overseas Entities.

- Registration of community interest companies (CICs). The SIA highlights that criminals abuse such companies to exploit individuals or communities.

As Companies House’s remit grows, this enhances researchers’ ability to trace ownership of corporates, other legal entity types, real estate and land to identify illicit networks and illegal activity.

Suggested reading: Understand how to verify OSINT sources by reading this blog.

Conclusion: is better detection and disruption of criminal activity coming?

With enhanced powers and a broader mandate, Companies House is becoming a more significant force in the fight against economic crime. The publication of the Strategic Intelligence Assessment marks a major departure from its former role, establishing it as an active intelligence player. The SIA does not underestimate the challenges ahead, as sophisticated criminals will find ways to evade controls. AI and deepfake technology may be a particular concern for the proposed identity verification process. However, more reliable data, combined with good OSINT tools and more active partnerships between Companies House and other investigative actors, offers significant potential for better detection and disruption of criminal activities.